A simple yet powerful simulator for investment strategies and portfolio backtesting.

Given a universe of

In a backtest we iterate in time (e.g. row by row) through the matrix and allocate positions to all or some of the assets. This tool helps to simplify the accounting. It keeps track of the available cash, the profits achieved, etc.

Install cvxsimulator via pip:

pip install cvxsimulatorThe simulator is completely agnostic to the trading policy/strategy. Our approach follows a rather common pattern:

We demonstrate these steps with simple example policies. They are never good strategies, but are always valid ones.

The user defines a builder object by loading prices and initializing the amount of cash used in an experiment:

>> > import pandas as pd

>> > from cvxsimulator import Builder

>> >

>> > # For doctest, we'll create a small DataFrame instead of reading from a file

>> > dates = pd.date_range('2020-01-01', periods=5)

>> > prices = pd.DataFrame({

...

'A': [100, 102, 104, 103, 105],

...

'B': [50, 51, 52, 51, 53],

...

'C': [200, 202, 198, 205, 210],

...

'D': [75, 76, 77, 78, 79]

...}, index = dates)

>> > b = Builder(prices=prices, initial_aum=1e6)

>> >Prices have to be valid, there may be NaNs only at the beginning and the end of each column in the frame. There can be no NaNs hiding in the middle of any time series.

It is also possible to specify a model for trading costs. The builder helps to fill up the frame of positions. Only once done we construct the actual portfolio.

We have overloaded the __iter__ and __setitem__ methods to create a custom loop.

Let's start with a first strategy. Each day we choose two names from the

universe at random.

Buy one (say 0.1 of your portfolio wealth) and short one the same amount.

>> > import pandas as pd

>> > import numpy as np

>> > from cvxsimulator import Builder

>> >

>> > dates = pd.date_range('2020-01-01', periods=5)

>> > prices = pd.DataFrame({

...

'A': [100, 102, 104, 103, 105],

...

'B': [50, 51, 52, 51, 53],

...

'C': [200, 202, 198, 205, 210],

...

'D': [75, 76, 77, 78, 79]

...}, index = dates)

>> > b = Builder(prices=prices, initial_aum=1e6)

>> > np.random.seed(42) # Set seed for reproducibility

>> >

>> > for t, state in b:

... # pick two assets deterministically for doctest

...

pair = ['A', 'B'] # Use first two assets instead of random choice

... # compute the pair

...

units = pd.Series(index=state.assets, data=0.0)

...

units[pair] = [state.nav, -state.nav] / state.prices[pair].values

... # update the position

...

b.position = 0.1 * units

... # Do not apply trading costs

...

b.aum = state.aum

>> >

>> > # Check the final positions

>> > b.units.iloc[-1][['A', 'B']]

A

951.409346

B - 1884.867573

Name: 2020 - 01 - 05

00: 00:00, dtype: float64

>> >Here t is the growing list of timestamps, e.g. in the first iteration

t is

A lot of magic is hidden in the state variable. The state gives access to the currently available cash, the current prices and the current valuation of all holdings.

Here's a slightly more realistic loop. Given a set of

>> > import pandas as pd

>> > from cvxsimulator import Builder

>> >

>> > dates = pd.date_range('2020-01-01', periods=5)

>> > prices = pd.DataFrame({

...

'A': [100, 102, 104, 103, 105],

...

'B': [50, 51, 52, 51, 53],

...

'C': [200, 202, 198, 205, 210],

...

'D': [75, 76, 77, 78, 79]

...}, index = dates)

>> >

>> > b2 = Builder(prices=prices, initial_aum=1e6)

>> >

>> > for t, state in b2:

... # each day we invest a quarter of the capital in the assets

...

b2.position = 0.25 * state.nav / state.prices

...

b2.aum = state.aum

>> >

>> > # Check the final positions

>> > b2.units.iloc[-1]

A

2508.939034

B

4970.539596

C

1254.469517

D

3334.665805

Name: 2020 - 01 - 05

00: 00:00, dtype: float64

>> >Note that we update the position at the last element in the t list using a series of actual units rather than weights or cashpositions. The builder class also exposes setters for such alternative conventions.

>> > # Setup code for this example

>> > import pandas as pd

>> > import numpy as np

>> > from cvxsimulator import Builder

>> >

>> > dates = pd.date_range('2020-01-01', periods=5)

>> > prices = pd.DataFrame({

...

'A': [100, 102, 104, 103, 105],

...

'B': [50, 51, 52, 51, 53],

...

'C': [200, 202, 198, 205, 210],

...

'D': [75, 76, 77, 78, 79]

...}, index = dates)

>> >

>> > b3 = Builder(prices=prices, initial_aum=1e6)

>> >

>> > for t, state in b3:

... # each day we invest a quarter of the capital in the assets

...

b3.weights = np.ones(4) * 0.25

...

b3.aum = state.aum

>> >

>> > # Check the final positions

>> > b3.units.iloc[-1]

A

2508.939034

B

4970.539596

C

1254.469517

D

3334.665805

Name: 2020 - 01 - 05

00: 00:00, dtype: float64

>> >Once finished it is possible to build the portfolio object:

>> > import pandas as pd

>> > import numpy as np

>> > from cvxsimulator import Builder

>> >

>> > dates = pd.date_range('2020-01-01', periods=5)

>> > prices = pd.DataFrame({

...

'A': [100, 102, 104, 103, 105],

...

'B': [50, 51, 52, 51, 53],

...

'C': [200, 202, 198, 205, 210],

...

'D': [75, 76, 77, 78, 79]

...}, index = dates)

>> >

>> > b3 = Builder(prices=prices, initial_aum=1e6)

>> >

>> > for t, state in b3:

...

b3.weights = np.ones(4) * 0.25

...

b3.aum = state.aum

>> >

>> > # Build the portfolio from one of our builders

>> > portfolio = b3.build()

>> >

>> > # Verify the portfolio was created successfully

>> > type(portfolio).__name__

'Portfolio'

>> >The portfolio object supports further analysis and exposes a number of properties, e.g.:

>> > # Setup code for this example

>> > import pandas as pd

>> > import numpy as np

>> > from cvxsimulator import Builder

>> >

>> > dates = pd.date_range('2020-01-01', periods=5)

>> > prices = pd.DataFrame({

...

'A': [100, 102, 104, 103, 105],

...

'B': [50, 51, 52, 51, 53],

...

'C': [200, 202, 198, 205, 210],

...

'D': [75, 76, 77, 78, 79]

...}, index = dates)

>> >

>> > b3 = Builder(prices=prices, initial_aum=1e6)

>> >

>> > for t, state in b3:

...

b3.weights = np.ones(4) * 0.25

...

b3.aum = state.aum

>> > portfolio = b3.build()

>> >

>> > # Access portfolio properties

>> > len(portfolio.nav) # Length of the NAV series

5

>> > portfolio.nav.name # Name of the NAV series

'NAV'

>> >

>> > # Check the equity (positions in cash terms)

>> > portfolio.equity.shape

(5, 4)

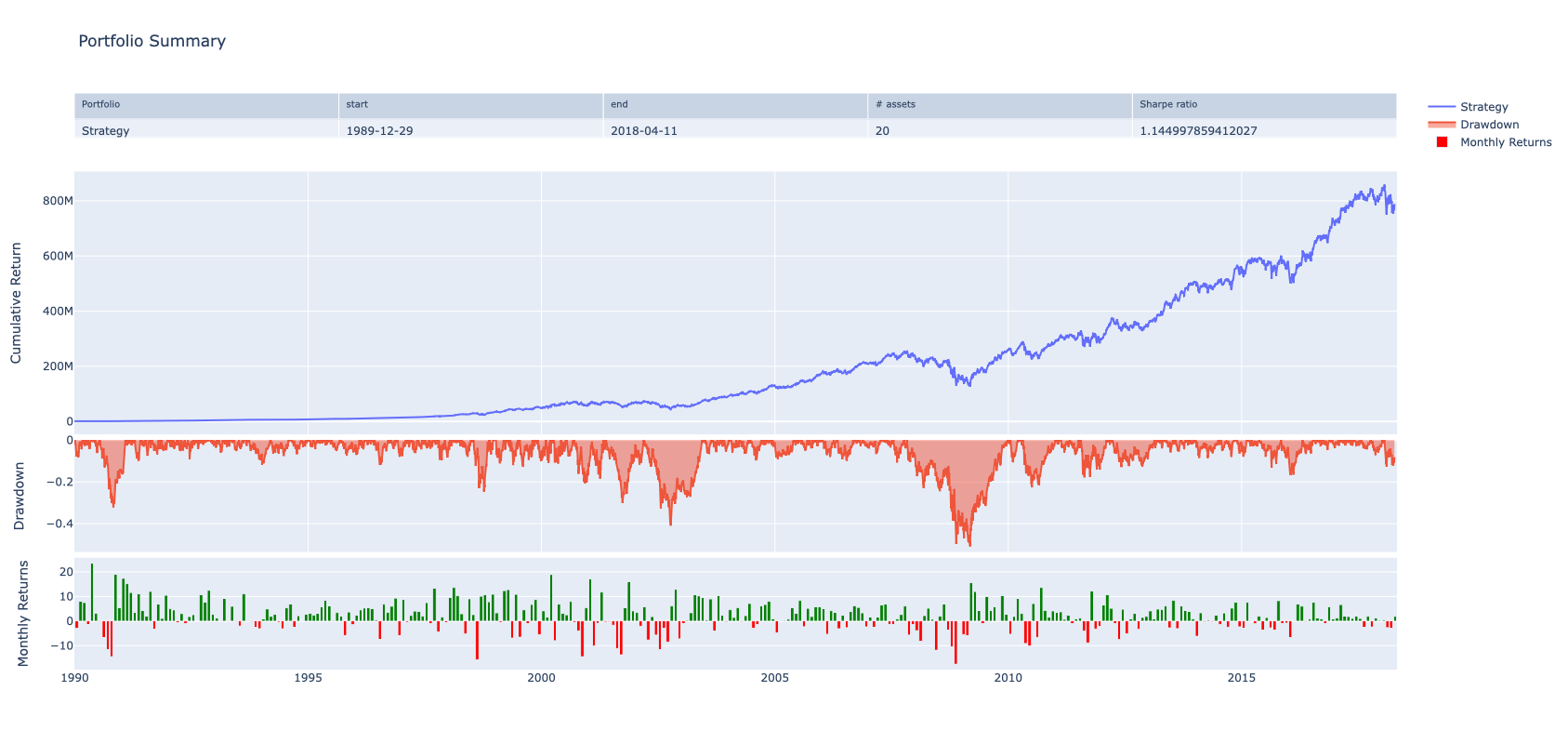

>> >It is possible to generate a snapshot of the portfolio:

>> > # Setup code for this example

>> > import pandas as pd

>> > import numpy as np

>> > from cvxsimulator import Builder

>> >

>> > dates = pd.date_range('2020-01-01', periods=5)

>> > prices = pd.DataFrame({

...

'A': [100, 102, 104, 103, 105],

...

'B': [50, 51, 52, 51, 53],

...

'C': [200, 202, 198, 205, 210],

...

'D': [75, 76, 77, 78, 79]

...}, index = dates)

>> >

>> > b3 = Builder(prices=prices, initial_aum=1e6)

>> >

>> > for t, state in b3:

...

b3.weights = np.ones(4) * 0.25

...

b3.aum = state.aum

>> > portfolio = b3.build()

>> >

>> > # Generate a snapshot (returns a plotly figure)

>> > fig = portfolio.snapshot()

>> >

>> > # For doctest, we'll just check the type of the returned object

>> > isinstance(fig, object)

True

>> >Start with:

make installThis will install uv and create the virtual environment defined in pyproject.toml and locked in uv.lock.

We install marimo on the fly within the aforementioned virtual environment. Execute:

make marimoThis will install and start marimo for interactive notebook development.

- Full documentation is available at cvxgrp.org/simulator/book

- API reference can be found in the documentation

- Example notebooks are included in the repository under the

bookdirectory

Contributions are welcome! Here's how you can contribute:

- Fork the repository

- Create a feature branch:

git checkout -b feature-name - Commit your changes:

git commit -m 'Add some feature' - Push to the branch:

git push origin feature-name - Open a pull request

Please make sure to update tests as appropriate and follow the code style of the project.

This project is licensed under the Apache License 2.0 - see the LICENSE file for details.

Copyright 2023 Stanford University Convex Optimization Group